Good morning. Texas is fast becoming the epicenter of the data center boom, driven by AI's insatiable appetite for power and space. With billions pouring in and the grid under pressure, developers are rewriting the rules on energy and infrastructure.

Today’s issue is brought to you by Mason Joseph Company—the most trusted FHA lender in Texas with 105 construction loans closed since 2016.

Market Snapshot

|

|

||||

|

|

Digital Texas

Texas Poised to Overtake as Top U.S. Data Center Hub

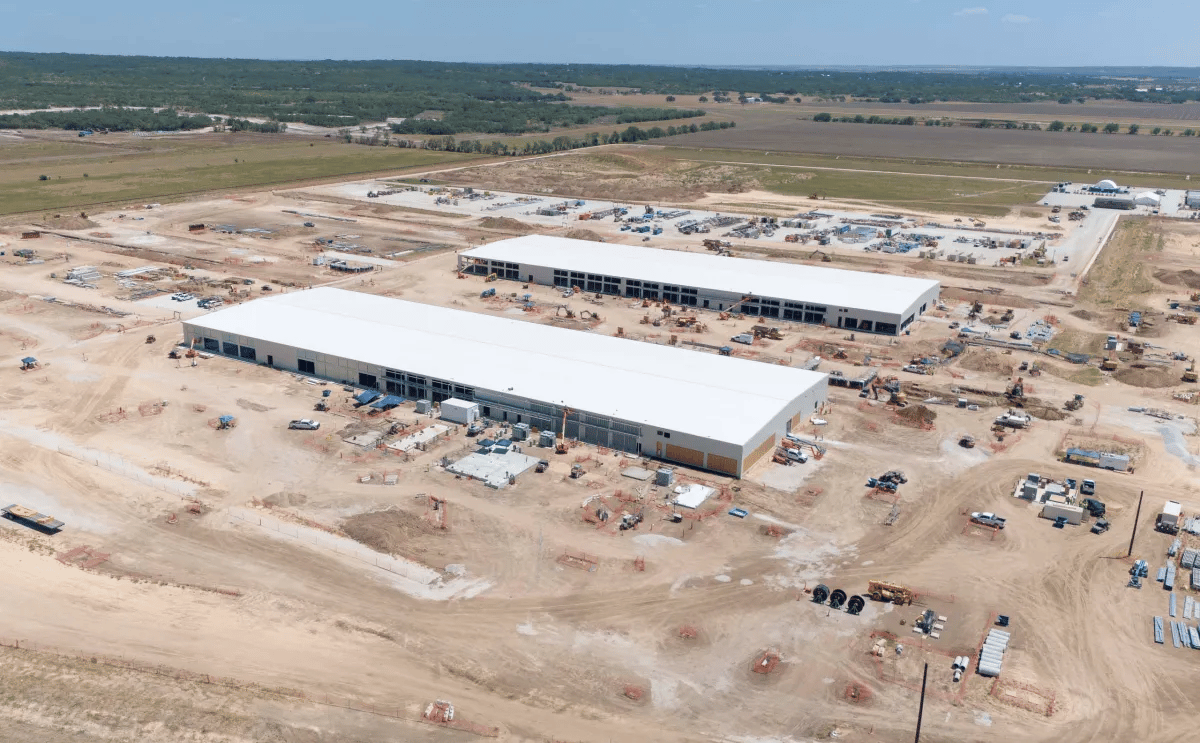

Construction takes place at a future Microsoft Data Center north of Castroville. Credit: Scott Ball / San Antonio Report

Fueled by AI demand and lax regulations, Texas is rapidly becoming the go-to destination for the next generation of massive, power-hungry data centers.

The next data capital: A Bloom Energy report projects that Texas will become the largest U.S. data center market within three years, driven by AI workloads that demand massive computing power. Energy use is expected to rise from 8 GW in 2025 to over 40 GW by 2028.

Big names, bigger projects: Tech giants like Google, Nvidia, and Anthropic are ramping up Texas projects, joined by efforts backed by Eric Schmidt and Rick Perry. The state is also poised to land part of “Project Stargate,” a $400B AI venture from OpenAI, Oracle, and SoftBank.

Why Texas? Texas offers a mix of cheap land, relaxed regulations, and abundant natural gas—ideal for developers avoiding permitting hurdles in states like CA and OR. As Bloom Energy’s Aman Joshi put it, “100 percent of onsite generation is largely happening with natural gas—and Texas certainly has a lot of access.”

Power shift: Grid congestion and slow approvals are pushing developers toward onsite power generation using natural gas and fuel cells. By 2030, one-third of U.S. data centers are expected to produce their own power, reshaping traditional energy planning.

Capital surge: In 2025 alone, Texas saw over $3.4B in new data center construction, including $1.4B in December. These projects are massive. By 2030, one in five U.S. data centers will exceed 1 GW in demand, rising to one in three by 2035, marking a major shift for real estate and infrastructure.

➥ THE TAKEAWAY

Lone Star power: Texas isn’t just building data centers—it’s rewriting the energy and development playbook. Powered by AI and natural gas, the Lone Star State is becoming ground zero for a new wave of power-hungry infrastructure.

TOGETHER WITH MASON JOSEPH COMPANY

105 FHA Construction Loans Closed Since 2016

Mason Joseph Multifamily Finance has closed 105 FHA-insured construction loans in Texas over the last decade – more than the next three FHA lenders combined.

That's why San Antonio–based Mason Joseph is the most trusted lender for high-leverage, low-interest FHA financing.

Whether your next multifamily development is in Texas, or any of the 49 other States, send us your budget & pro forma and in 24 hours we can tell you how an FHA-insured loan will improve your returns.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

Around Texas

➥ Austin’s once red-hot office market continues to lag behind Houston and Dallas, with weak absorption, rising vacancies, and an oversupply of premium space.

➥ Highwoods Properties' $108M office acquisitions in Dallas and Raleigh mark a renewed push by institutional buyers into Sun Belt markets.

➥ A 1980s office building in Dallas’ Uptown is set for a new life as a 140-key hotel, as Cawley Partners and Alamo Manhattan double down on repositioning aging assets.

➥ The Dallas Stars' potential move to Plano’s Willow Bend mall site could spark a $1B arena project, boosting suburban growth and intensifying competition with Frisco.

➥ AT&T’s exit will leave 1M+ SF vacant, deepening Dallas CBD’s office struggles as tenants favor Uptown and suburban hubs.

➥ Asterisk helped relaunch The Row, a 314-acre mixed-use project in Southeast Austin with 7M SF of commercial space and thousands of homes.

Follow the Money

| MULTIFAMILY HOUSTON RREAF acquired a foreclosed 510-unit Houston complex, betting on value-add potential amid Texas' multifamily distress wave. |

| DATA CENTERS CASTROVILLE Microsoft is investing $400M in a 195K SF data center in Castroville, near San Antonio, with another $482M project potentially on deck. |

| DATA CENTERS DALLAS Crow Holdings and CleanArc will develop a 245MW data center campus in central Dallas, with a 70MW first phase delivering in 2027. |

| RETAIL SAN ANTONIO Headwall and Fifth Corner acquired San Antonio’s 100K SF Sunset Ridge center, with plans to revitalize the historic community hub. |

| MULTIFAMILY SAN MARCOS Z Modular refinanced its 384-unit Flatz 512 project in San Marcos with a $62.3M bridge loan, as modular multifamily gains ground across Texas. |

| BUILT-TO-RENT TERRELL Dominium is investing $70M into a 350-unit built-to-rent project in Terrell, marking its second BTR community. |

| MULTIFAMILY PFLUGERVILLE Virga Capital acquired The Beacon at Pfluger Farm, a 258-unit community in Pflugerville, marking its first Austin-area purchase. |

| MULTIFAMILY AUSTIN Machine Investment Group and Alta Real Estate Partners acquired Rise 120 in suburban Austin at a 30% discount to developer cost. |

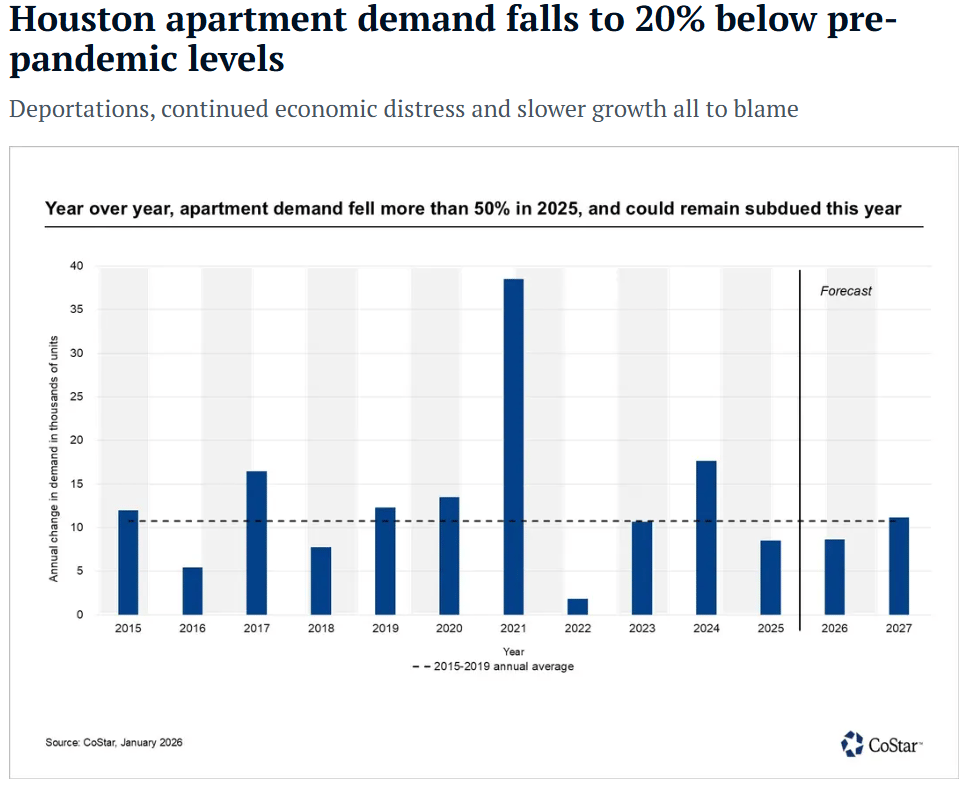

📈 CHART OF THE WEEK

Houston apartment demand has dropped to 20% below pre-pandemic levels, driven by economic strain, slower growth, and rising deportations, according to CoStar.

More from CRE Daily

📬 Newsletters: Stay ahead of the market with our national CRE Daily newsletter — or get hyper-local insights from CRE Daily New York.

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have {{ rp_num_referrals }} referrals, only {{ rp_num_referrals_until_next_milestone }} away from receiving {{ rp_next_milestone_name }}.