Good morning. Houston’s industrial market ended 2025 on a high note, posting its strongest quarterly absorption in years. Major move-ins and surging demand are setting the tone for 2026.

Today’s issue is brought to you by Mason Joseph Company—the most trusted FHA lender in Texas with 105 construction loans closed since 2016.

Market Snapshot

|

|

||||

|

|

Tenant Magnet

Houston’s Industrial Market Ends 2025 with Record Absorption

Tenant demand and leasing momentum send Q4 net absorption to multi-year highs, even as construction remains strong.

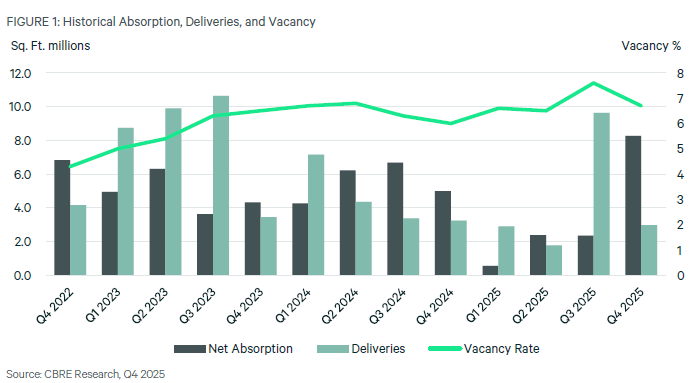

Houston’s industrial high: Houston’s industrial market ended 2025 with 8.3M SF of net absorption in Q4—more than triple Q3’s total and the strongest quarterly gain in years. Annual absorption hit 13.6M SF, even with 17.2M SF of new space delivered.

Major move-ins: West Houston led Q4 with 2.3M SF of absorption, fueled by Tesla, Pepsi, and Inventec. Foxconn added 2M SF of high-tech space, with 656K SF more coming, while Eli Lilly’s $6.5B bet on Generation Park underscores the shift toward advanced manufacturing.

Vacancy holds: Despite robust construction—129 projects totaling 21.5M SF underway—vacancy fell to 6.7%, down 90 bps quarter-over-quarter. With just 16% of space pre-leased, the market is signaling confidence in sustained demand heading into 2026.

Submarket winners: The Northwest submarket led Q4 in construction (6.3M SF), leasing (2.3M SF), and deliveries (1.97M SF), contributing to 20M SF of new occupancy over five years. For 2025, the West (2.9M SF), Southeast (2.6M SF), and Northwest (2.2M SF) led in move-ins, with the Northeast adding 1.4M SF in Q4, driven by 3PL and consumer goods demand.

Leasing stays strong: Leasing hit 31.3M SF in 2025, up 800K SF YoY, with 7M SF signed in Q4. Notable deals included SEG Solar, Enchanted Rock, and ProEnergy. High-tech manufacturing gained traction, especially at NW Reservoir District Park.

➥ THE TAKEAWAY

Bullish outlook: Houston’s industrial market is absorbing space nearly as fast as it’s built. With vacancy down, supply moderating, and major tenants expanding, 2026 is set to continue the momentum.

TOGETHER WITH MASON JOSEPH COMPANY

105 FHA Construction Loans Closed Since 2016

Mason Joseph Multifamily Finance has closed 105 FHA-insured construction loans in Texas over the last decade – more than the next three FHA lenders combined.

That's why San Antonio–based Mason Joseph is the most trusted lender for high-leverage, low-interest FHA financing.

Whether your next multifamily development is in Texas, or any of the 49 other States, send us your budget & pro forma and in 24 hours we can tell you how an FHA-insured loan will improve your returns.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

Around Texas

➥ DFW owners are converting obsolete offices to industrial uses as demand outpaces office leasing, with rezoning and capex driving longer timelines but better exit liquidity.

➥ Houston retailers logged consecutive quarters of net absorption, tightening occupancy and limiting new supply, which supports steady rent growth for strip and neighborhood centers.

➥ Dallas added over 60,000 apartments in the past decade, with the majority of new construction clustered in five central zip codes, led by downtown’s 75201.

➥ A planned ICE detention center in North Texas would add thousands of beds, reshaping local infrastructure needs and creating construction and operations jobs.

➥ Houston apartment occupancy held firm in December as deliveries slowed, concessions stabilized, and rent growth remained modest ahead of 2026 supply additions.

➥ Pickle Rage is planning additional Austin locations via adaptive reuse, expanding experiential leasing demand for flex and retail spaces with shorter buildout timelines.

Follow the Money

| MULTIFAMILY LUBBOCK Altus Equity acquired two Texas apartment communities, expanding its Sun Belt footprint and signaling continued conviction in stabilized multifamily cash flow. |

| MULTIFAMILY DALLAS Dallas multifamily developers secured C-PACE financing to bridge capital stacks, lowering upfront equity needs amid tighter construction lending. |

| HOSPITALITY NORTH TEXAS Loews is planning a third North Texas hotel as part of a $500M project, reinforcing long-term bets on convention-driven lodging demand. |

| RETAIL HOUSTON ShopOne Centers and Pantheon Ventures acquired a Houston retail center, adding grocery-anchored exposure with in-place income and leasing upside. |

| MULTIFAMILY FORT WORTH The NRP Group delivered a Fort Worth health and housing project, combining affordable units and medical services under public-private funding. |

| Industrial Houston Dallas-based developer Jackson-Shaw fully leased its new 146K SF Houston industrial project, Interchange 249, just one month after completing construction. |

📈 CHART OF THE WEEK

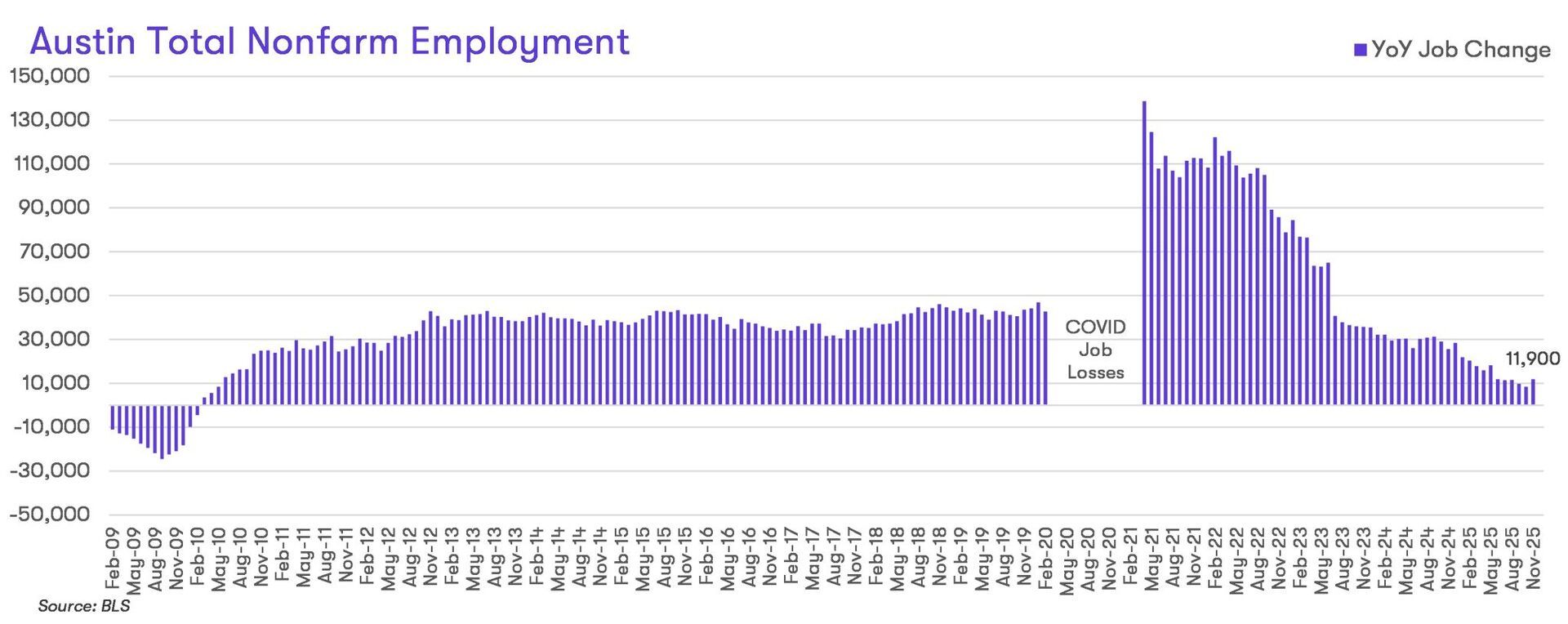

Austin job growth slowed to 11,900 in 2025, with losses in high-paying sectors offset by government hiring, suggesting housing demand will lean more on migration and household formation into 2026.

More from CRE Daily

📬 Newsletters: Stay ahead of the market with our national CRE Daily newsletter — or get hyper-local insights from CRE Daily New York.

🎙️Podcast: No Cap by CRE Daily delivers an unfiltered look at the biggest trends—and the money game behind them.

🗓️ CRE Events Calendar: The largest searchable calendar of commercial real estate events—filter by city or sector.

📊 Market Reports: A centralized hub for brokerage research and market intelligence, all in one place.

📈 Fear & Greed Index: A fully interactive sentiment tracker on the pulse of CRE built in partnership with John Burns Research & Consulting.

You currently have {{ rp_num_referrals }} referrals, only {{ rp_num_referrals_until_next_milestone }} away from receiving {{ rp_next_milestone_name }}.